Visa Flexible Credential

While working at Visa, cardholders frequently express concerns about managing multiple cards. Studies reveal that most people have at least three accounts, raising the question: how can we simplify day-to-day management of multiple cards and accounts?

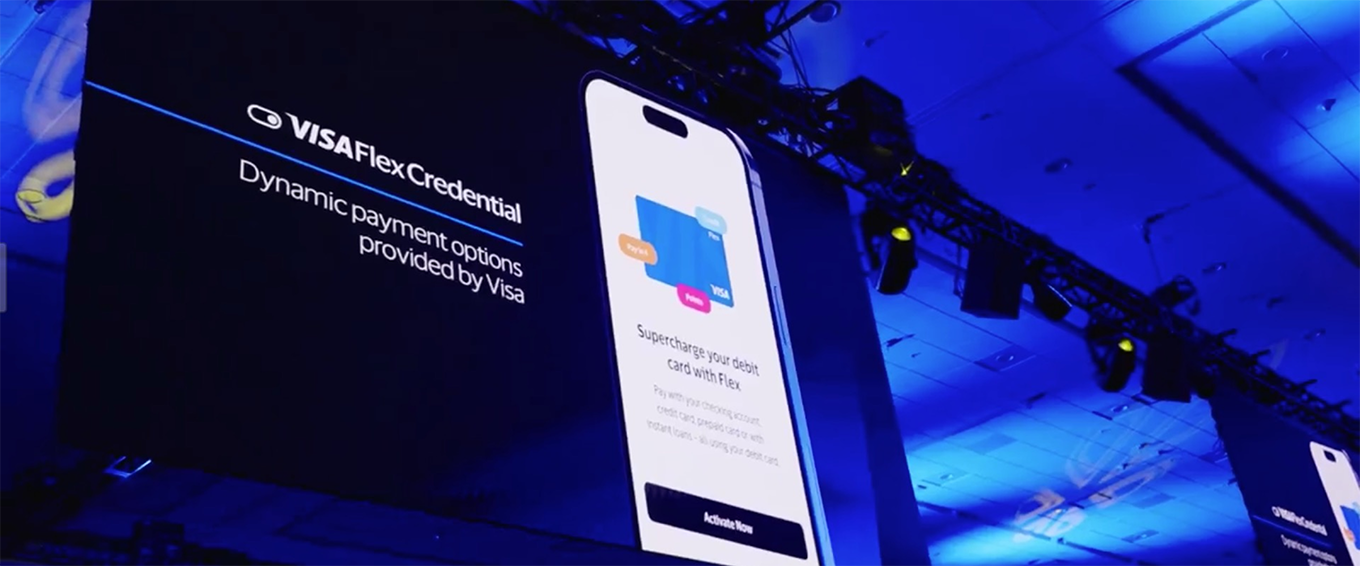

The product was announced at the 2024 Visa New Product Payment Forum.

Some of my work is under NDA, below features have been modified / released to the public. Products and images are owned by Visa Inc or prospective clients.

PILOT PARTNERS

- JAPAN: SMBC Bank

Olive card is the first all-in-one card that combines Banking account, debit, credit, and point payments. - USA: Affrim, TD Bank, Wells Fargo

PROJECT RELEASED

2024 MAY

MY CONTRIBUTIONS

What did I do?

- Conducted attitudinal research to understand user needs around multi-account management.

- Collaborated cross-regionally to support product innovation for a single dynamic credential that integrates debit, credit, installment, and loyalty options.

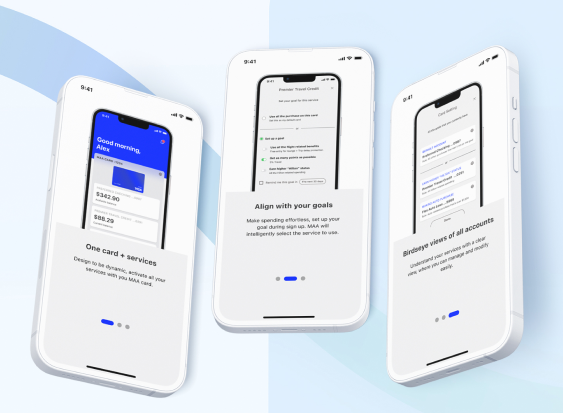

- Developed interfaces to help users set account goals, manage preferences, and understand product value.

- Contributed to the global expansion strategy, with a key announcement at the 2024 Visa Payment Forum and upcoming U.S. pilot.

HOW MIGHT WE

simplify payment options on one card

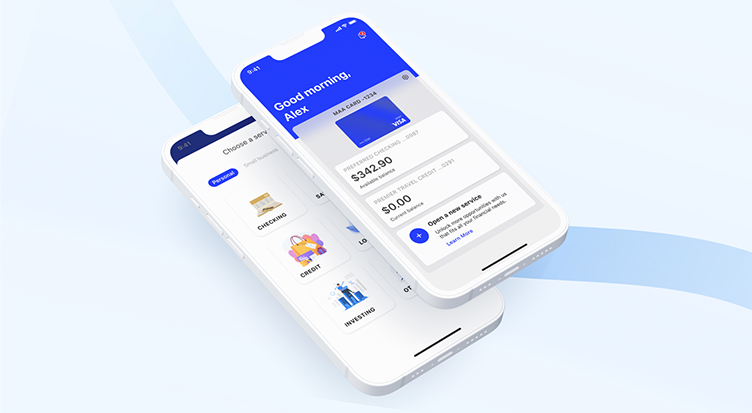

For years, managing finances meant juggling multiple cards—one for each credit line or account for separate cards. Imagine if all of these could merge into one sleek, flexible solution, freeing up wallet and simplifying transactions.

How do we map multiple funding sources to a single card.

Allowing users to navigate between

Debit/ Credit

Installment

Loyalty Point

Project Goals

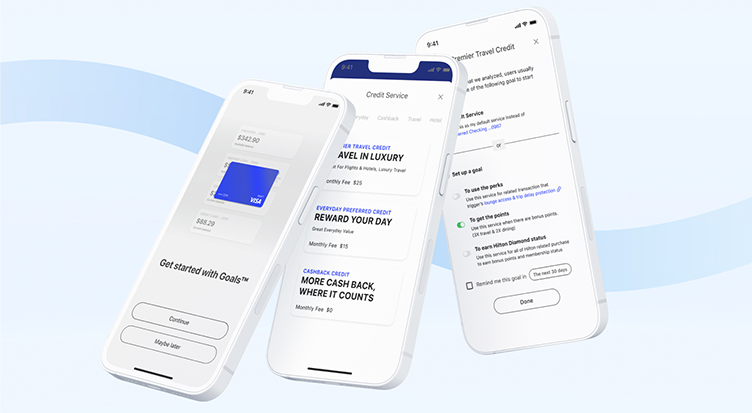

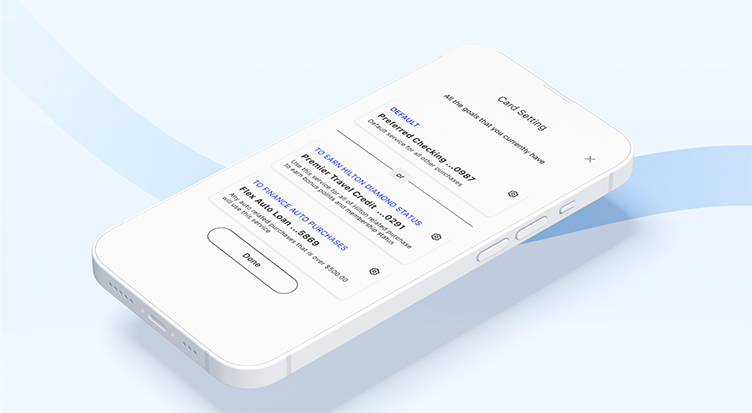

- Help cardholders to figure out how they should be using their accounts

- Assist cardholders in keeping track of the goal for each account

- Revalue the cardholder’s goal for each account as it changes from time to time

- Educate cardholders on the product value and how the issuer designs it.

- Provide insights for the issuer to fully understand how the customers actually want from their accounts.

Multi-Account Service

A single, dynamic credential that helps users access, manage, and make the best out of multiple accounts and services.

2024 Visa Payment Fourm Product Release

Conclusion

Japanese bank SMBC’s Olive card is the first active card that enables this service worldwide in 2023. Soon, this feature will roll out across regions and issuers, with financial institutions and card holders gaining access worldwide, starting with a U.S. pilot later in 2024.

2024 Eric Chen - Images and content may not be used without written permission. All rights reserved.®